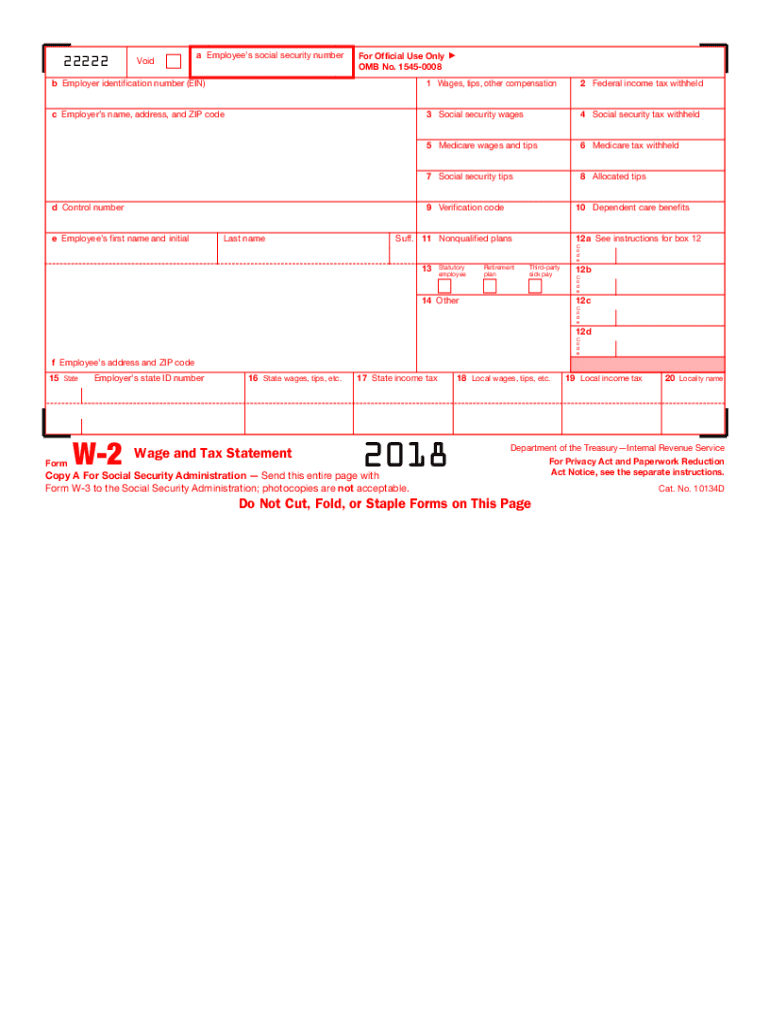

IRS W-2 2018 free printable template

Instructions and Help about IRS W-2

How to edit IRS W-2

How to fill out IRS W-2

About IRS W-2 2018 previous version

What is IRS W-2?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS W-2

What should I do if I find errors on my IRS W-2 after it has been filed?

If you identify errors on a submitted IRS W-2, you should file a corrected version known as Form W-2c. This form allows you to amend any mistakes related to the employee’s information or amounts reported. It's important to submit the corrected form as soon as possible to ensure proper tax reporting.

How can I verify that my IRS W-2 has been processed?

To verify the processing of your IRS W-2, you can use the IRS's online 'Get Transcript' tool or contact the IRS directly. You may also want to check your e-filing status if you submitted electronically. Keeping a record of submission confirmation can help in tracking.

What are some common mistakes to avoid when dealing with the IRS W-2?

Common mistakes include incorrect social security numbers, misspellings of names, and failing to report certain income types. Double-checking entered information and ensuring compliance with IRS specifications can help reduce errors. If you're unsure, consider seeking assistance from a tax professional before submitting.

What should I do if I receive a notice from the IRS regarding my W-2?

If you receive a notice from the IRS about your W-2, read the notice carefully to understand the issue cited. You may need to provide additional documentation or submit a response by the specified date. It's advisable to keep thorough records and consult with a tax advisor for guidance on how to proceed.

See what our users say